Where 5StarsStocks.com Fits in the Research Landscape

5StarsStocks.com presents itself as an AI-powered stock research platform built for retail investors who want fast insights without navigating dense financial reports. Its appeal lies in simplicity. Star ratings, sector heat maps, and alerts promise clarity in markets that often feel overwhelming.

That same simplicity, however, is what pushes many users to look elsewhere.

As investors spend more time with the platform, questions tend to surface around methodology transparency, long-term performance, and how much trust should be placed in a single composite score. For some, the platform works as a starting point. For others, it feels incomplete once real money is involved.

This is where alternatives enter the picture.

Why the Search for Alternatives Happens

The interest in alternatives is not driven by novelty. It is driven by friction.

Investors who move beyond casual exploration often want to understand how conclusions are reached, not just what the conclusions are. When AI scores are not fully explainable or independently verifiable, users naturally seek tools that offer clearer logic, documented processes, or narrower focus.

In most cases, the goal is not to replace 5StarsStocks.com entirely, but to supplement or cross-check its output with platforms that prioritize transparency, depth, or specialization.

The Main Alternatives Investors Compare Against 5StarsStocks.com

Before diving into individual platforms, it helps to clearly identify the alternatives most commonly discussed alongside 5StarsStocks.com. These are not random tools, but platforms that consistently appear in independent comparisons and investor discussions.

The seven alternatives most frequently referenced are:

● Morningstar

● Zacks Investment Research

● Investopedia

● Simply Safe Dividends

● DividendStocks.cash

● Stock Rover

● Yahoo Finance

Each of these platforms solves a slightly different problem, which is why they are often used together rather than in isolation.

Morningstar and the Case for Valuation Discipline

Morningstar is often the first stop for investors who feel uneasy relying on opaque AI ratings. Its research is built around fair value estimation, economic moat analysis, and long-term fundamentals.

What separates Morningstar from platforms like 5StarsStocks.com is accountability. Reports are written by named analysts, valuation assumptions are explained, and the firm avoids promising short-term outperformance. For investors who care more about downside protection than rapid signals, this conservative posture matters.

Zacks Investment Research and Earnings-Based Signals

Zacks appeals to investors who want rankings, but with a clearer backbone. Its well-known 1 to 5 ranking system is rooted in earnings estimate revisions, a factor that has been studied for decades.

Unlike AI-first platforms that blend many signals into a single score, Zacks focuses on a narrower driver of performance. That focus makes it easier for users to understand why a stock is ranked highly and what might cause that ranking to change.

Investopedia as a Reality Check Tool

Investopedia does not compete with 5StarsStocks.com on stock picks. Instead, it competes on understanding.

Many investors use Investopedia when they realize they do not fully grasp the metrics behind AI-generated recommendations. Rather than offering answers, it explains concepts, ratios, and financial mechanics so users can evaluate claims themselves.

In practice, it becomes the place investors go to sanity-check AI outputs before acting on them.

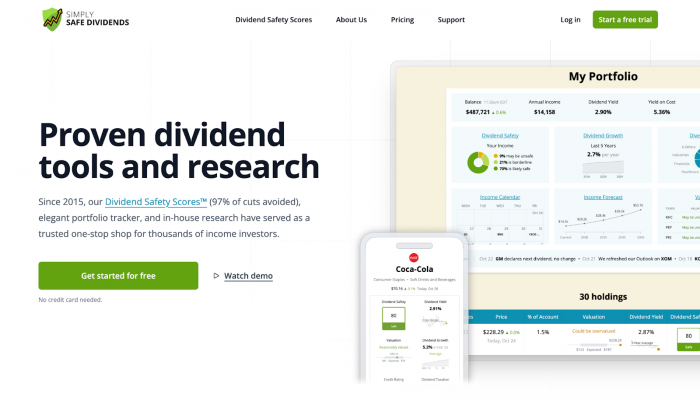

Simply Safe Dividends and Income Reliability

Simply Safe Dividends exists for a very specific audience. Investors who care about income stability rather than growth narratives.

Its research revolves around dividend safety, payout sustainability, and portfolio income tracking. Unlike 5StarsStocks.com, which spans many sectors and strategies, Simply Safe Dividends deliberately limits its scope.

That limitation is its strength. For retirees and income-focused investors, clarity around risk matters more than thematic excitement.

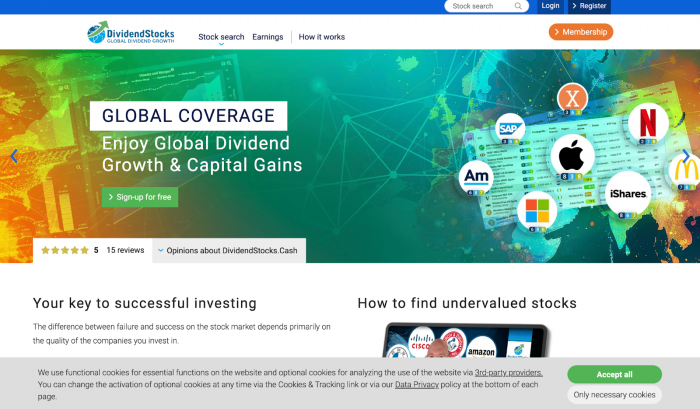

DividendStocks.cash and Transparent Dividend Analysis

DividendStocks.cash takes a more data-forward approach to dividend investing. Instead of scores or rankings, it emphasizes historical dividend behavior, payout ratios, and valuation ranges.

Investors who prefer to draw their own conclusions often gravitate toward this platform because it exposes the underlying numbers rather than summarizing them into a single recommendation.

It is frequently used alongside other tools, not as a standalone signal generator.

Stock Rover for Advanced Self-Directed Investors

Stock Rover is where many investors end up after outgrowing simplified platforms. It offers extensive metrics, portfolio modeling, and forecasting tools that allow users to control assumptions directly.

While it requires more effort to learn, it rewards that effort with explainable analysis. For investors who want AI-assisted insights without surrendering control, this balance is appealing.

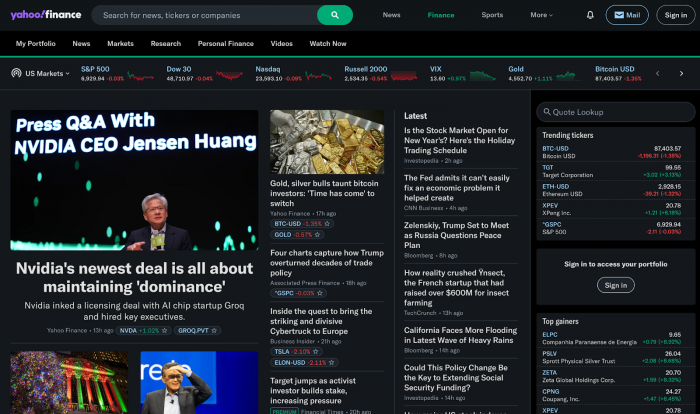

Yahoo Finance as a Foundational Reference

Yahoo Finance remains one of the most widely used platforms because it offers something many AI tools do not. Direct access to raw data.

Financial statements, filings, historical charts, and news are available without heavy interpretation layered on top. Many investors use it as a neutral reference point to confirm or challenge conclusions drawn elsewhere.

Its value lies in visibility rather than guidance.

How Investors Actually Combine These Tools

Most experienced investors do not replace one platform with another. They layer them.

A common workflow starts with idea discovery on platforms like 5StarsStocks.com, followed by valuation checks on Morningstar, earnings validation via Zacks, income assessment through dividend-focused tools, and final verification using Yahoo Finance or Investopedia.

This approach reduces dependence on any single system and shifts decision-making back to the investor.

Final Perspective

5StarsStocks.com addresses a real need. Simplicity in a noisy market. Alternatives exist because simplicity eventually runs into its limits.

The platforms discussed here succeed not because they predict better outcomes, but because they make assumptions visible. For investors who care about trust, process, and long-term discipline, that visibility matters more than any star rating.

The smartest move is not choosing the most confident platform, but building a toolkit that forces you to think clearly before you act.

Comments