In today’s fast-paced business world, managing finances efficiently is crucial. For small businesses, GST invoicing and accounting can be a complicated process, especially when they’re just starting. Swipe Billing promises to simplify the process of creating GST invoices, tracking inventory, and maintaining records in a way that’s both easy to use and affordable.

As a free-to-start platform, it offers businesses an attractive solution without the upfront cost. In this review, we’ll take a closer look at Swipe Billing, its core features, and whether it truly meets the needs of small business owners, freelancers, and entrepreneurs.

What Does Swipe Billing Offer?

Wide Range of Features Tailored for Small Businesses

Swipe Billing has been designed to cater specifically to small business owners and freelancers. Here’s a closer look at the platform’s key features:

GST Invoicing and Quotation Creation

Generate GST-compliant invoices instantly, even on the go. Whether it’s a service-based invoice or a product invoice, Swipe makes it easy to create professional invoices quickly.

The tool automatically calculates GST, applies the correct tax rate, and generates the invoice in multiple formats, which can be emailed directly to clients.

The platform also lets you create quotations that can later be converted into invoices. This is a great time-saver for businesses that frequently send price estimates before finalizing deals.

Inventory Management

Real-time stock tracking is one of the standout features. You can track inventory levels, get low-stock alerts, and update product quantities instantly.

If you sell products that come in different variations (size, color, etc.), Swipe allows for detailed product categorization to keep track of everything efficiently.

Expense Tracking

Track expenses easily with Swipe’s expense management feature. You can categorize expenses (e.g., office supplies, travel, utilities) and attach receipts to each entry for better financial record keeping.

The platform generates expense reports that help you analyze where your money is going, which is essential for tax filing and maintaining a clear picture of your financial health.

Multi-User Support

If you have a team or multiple users handling different aspects of your business, Swipe allows for multi-user access. This feature enables different people (like accountants, inventory managers, etc.) to have specific roles and access levels.

Each user gets their own login credentials and can access only the data relevant to their role in the business.

Reporting and Analytics

Swipe provides a variety of reports that offer detailed insights into sales, inventory, and expenses.

Profit & Loss statements, GST reports, and daily sales reports are easily accessible and can be exported in PDF or Excel format, perfect for tax filing or presenting to stakeholders.

E-Way Bill and E-Invoice Generation

For businesses involved in goods transportation, Swipe enables you to generate e-way bills and e-invoices directly from the platform, streamlining the GST compliance process.

Payment Gateway Integration

Swipe Billing allows integration with various payment gateways such as Paytm, Razorpay, and Instamojo to accept payments online, making it easier for clients to pay their invoices directly from the platform.

Is Swipe Billing Free?

Swipe Billing Free Tier and Paid Plans

The free version of Swipe Billing is one of its biggest advantages. It allows small businesses to get started with unlimited GST invoices, quotations, and expense tracking without any upfront cost. The free plan covers most of the core functionality that a small business needs for day-to-day invoicing and business management.

What’s Included in the Free Plan?

- Unlimited invoices and quotations: You can create GST-compliant invoices, track payments, and even send automatic reminders to clients.

- Basic inventory management: Track stock levels, update quantities, and categorize products.

- Expense management: Log and categorize business expenses.

- GST reports: Generate GST returns and keep your business compliant with tax regulations.

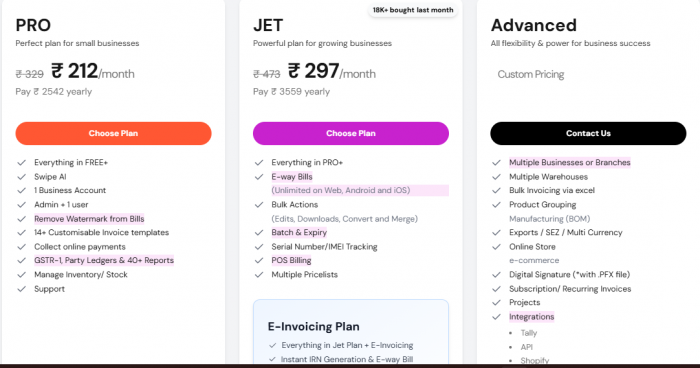

While the free version is comprehensive, businesses that need additional features like advanced reports, multi-user access, and priority customer support can opt for the paid plans. These plans are designed to grow with your business.

How Does Swipe Billing Compare to Vyapar?

Key Differences Between Swipe and Vyapar

If you’re looking for a GST billing tool, you might also come across Vyapar, another popular invoicing solution. Here's how the two platforms compare:

User Interface and Ease of Use

Swipe Billing focuses on simplicity. The user interface is clean and straightforward, making it accessible even for those who have little to no accounting knowledge.

Vyapar, while offering more advanced features, can feel a little more complex due to its focus on comprehensive business accounting. If you’re looking for a user-friendly experience, Swipe Billing might be a better choice.

Features

Swipe Billing is geared towards GST invoicing, expense tracking, and basic inventory management. It’s perfect for small businesses, freelancers, and those who don’t need a ton of extra features.

Vyapar, on the other hand, offers a more comprehensive solution, with tools for accounting, balance sheets, profit & loss statements, and inventory management.

Pricing

Swipe Billing offers a free plan that covers all basic needs, making it ideal for small businesses with limited budgets.

Vyapar has paid plans that provide more advanced accounting features right from the start. Vyapar may be better suited for businesses that need full accounting solutions rather than just invoicing.

How Does Swipe Billing Generate Revenue?

Monetization Strategy: Premium Plans and Affiliate Links

Swipe Billing primarily generates revenue from its premium subscriptions. While the free version offers essential features, businesses that require advanced reporting, multi-user support, and additional features will need to upgrade to the paid plans.

In addition to premium plans, Swipe may also rely on affiliate marketing to generate additional income, linking users to third-party apps and business tools.

Who Is Behind Swipe Billing?

Founder and Company Overview

Swipe Billing is developed by NextSpeed Technologies, an innovative technology company based in India. While the site doesn’t offer extensive information about the founders, NextSpeed Technologies has focused on building simple, user-friendly software solutions tailored for small businesses and freelancers.

User Feedback: What Are People Saying About Swipe Billing?

Customer Reviews and Testimonials

From independent review platforms like Capterra and SoftwareSuggest, users have generally praised Swipe Billing for its ease of use and comprehensive features:

On Capterra, users have highlighted its quick invoicing capabilities, with many calling it a time-saver. The GST compliance feature has also been appreciated by users who want to ensure their invoices are accurate.

On SoftwareSuggest, users have commended the platform for its simple interface and value for money. The free tier allows users to test the features before deciding to upgrade, which has been a big plus for small business owners.

What Are the Main Benefits of Using Swipe Billing?

Top Features That Make Swipe Billing Stand Out

GST Compliant Invoices: Swipe helps businesses stay compliant with Indian GST regulations, offering ready-made GST reports and e-invoice generation.

Ease of Use: A clean, intuitive interface that requires no accounting expertise to operate.

Free Plan: The free plan covers most needs, making it an excellent choice for startups and small businesses.

Integrated Payments: Accept payments directly through payment gateway integration.

Multi-Device Access: Access your account from any device, whether it's a smartphone or desktop.

Quick Setup: Set up and start generating invoices in minutes with no steep learning curve.

Final Thoughts: Is Swipe Billing Right for Your Business?

After reviewing Swipe Billing, it’s clear that this tool provides a simple, effective solution for small businesses and freelancers. With its easy-to-use invoicing, GST compliance, and the ability to manage expenses and inventory, Swipe Billing makes day-to-day business management much more efficient.

While it may not have the extensive features of a full-fledged accounting software like Vyapar, it’s perfect for small businesses and freelancers who need a straightforward invoicing solution without the complexity of traditional accounting software.

If you’re looking for a simple, fast, and affordable billing tool that meets the GST requirements in India, Swipe Billing is definitely worth checking out. However, for businesses that require more advanced accounting features, you may need to look into other solutions like Vyapar.

Comments